BUDGETING

Every Condominium and Homeowners Association is dependent upon a steady flow of assessment revenue to fund its operations and maintain the property. Some Associations have alternative sources of revenue such as laundry room receipts, parking garage fees, golf course greens fees, etc. However, it is assessments which are the “life blood” of the Association whether it is a monthly, quarterly or annual fee.

Association operations funding is budget based. Each year, a Board of Directors or a finance committee will compile data, crunch numbers, make projections and develop an operating budget. These numbers include the cost of all administration and maintenance plus a “fudge factor” for reserves. Assessments are then based upon dividing this gross number on either a per capita or percentage of ownership basis depending upon the type of Association. Annual operating expenditures are frequently referred to as recurring expenses.

In a perfect world, a developer sets up an initial reserve account, usually funded by collecting two to three months’ assessments from each initial purchaser at closing. The first homeowner elected Board, after conducting an audit, should immediately retain a professional consultant to conduct a Reserve Study. Based upon the aforestated, each year the Board of Directors will factor into the operating budget additional collections to fund the reserve account. Theoretically, monies collected for reserves should be divided into thirds; one-third for emergencies and contingencies with immediacy; one-third for intermediate projects performed and regularly scheduled such as painting, seal coating, landscaping replacements, etc., and one-third for long-term capital reserves. These are the major expenditures that have ten to twenty years of useful life remaining but could cost hundreds of thousands or even millions of dollars, such as roofs and parking lots and streets.

SPECIAL ASSESSMENTS

As buildings age, as Boards discover the property was not built as well as the developer promised, and as warranties expire, more and more money is needed to keep the property values up, in a habitable condition and to protect property values and Owners’ investments. When the need to fund these large capital projects becomes apparent, most associations will not have enough money to 100% fund the project (accolades to any Association that does!).

Whether the Association negotiates a bank loan, levies a special assessment, adopts a revised budget and taps the reserve, ultimately the money must be collected (and repaid) from Owners’ assessment payments. In a tight economy, for Owners on fixed incomes or Owners who are just making ends meet, this can be a traumatic experience.

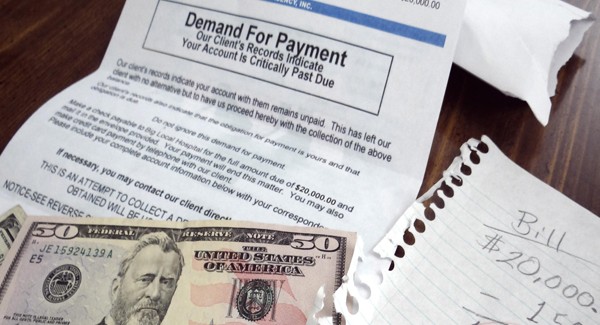

Imagine a thirty (30) year old building of one hundred (100) units with One Hundred Thousand ($100,000.00) dollars in the bank that has a new roof, new balconies, recently planted with attractive landscaping and parking lots in pristine condition. Can the Owners breathe easy? Not so fast! Cracks are starting to appear in the interior walls of one side of the building, due to soil erosion and settlement. The curtain wall is pulling away (face brick) from the building and estimated repair cost is Two Million ($2,000,000.00) Dollars. Cost per Owner (you can do the math) would be Twenty Thousand ($20,000.00) Dollars. Far-fetched? No, this is an actual scenario.

The Board of Directors must now develop a strategy to get through this financial crisis as well as deal with it on a human level, find the necessary funds from its mostly senior and recent immigrant population and get the project completed quickly, but in a high-quality fashion and manage the move out and moving of twenty-five (25%) percent of the Owners while the work is being performed. (Whew!) In addition, the city is monitoring the progress very closely because they have been advised that there is a safety risk looming.

PROCEDURE

Here is a tip on how NOT to adopt a special assessment. First, the Board meets and discusses the issues at a poorly attended meeting. Second, based on the recommendations of the contractor, who is going to do the work, they agree to proceed, sign a contract and give him half down as a deposit. Then after the horse is already out of the barn, they close the door. They let the Owners know the bad news with little or no explanation.

If I were on this Board, I would change my phone number, and grow a beard. Owners who get the bad news from a single notice feel betrayed, disaffected, alienated, intimidated, powerless and overwhelmed. This will result in cries to remove the Board, false accusations of impropriety and the largest sin of all, the failure to communicate. The natural reaction of a Board faced with this type of outcry is typically to circle the wagons and become self righteous, defensive and sometimes aggressive.

Stop! This can all be avoided. Adopting a large special assessment is painful for the Board members as well as the Owners, but there are a number of steps a smart Board can take to ease the pain and have the large majority of the community supporting the Board’s efforts rather then opposing it.

NOTICE

First, when a problem is identified, a leaking roof, a pothole filled parking lot, shaky balconies, etc., the Owners should immediately be notified that this problem has been reported to the Board and secondly, the Board is conducting an investigation. Notice can be simple as a letter, a posting on the website or bulletin Board or an item in the newsletter.

Second, the Board needs to solicit bids and retain the services of a qualified expert. A consultant must be hired who specializes in the science of the particular amenity that needs to be repaired and replaced – an engineer architect or a specialized consultant. The most important thing is that a Board must never solicit an opinion from a contractor who is going to do the work. Also, never hire a consultant who has an economic interest in a job for the report they are going to prepare.

Once the consultant has been selected, the Owners should be notified as to the hiring of the consultant because they may be suspicious of the stranger wandering the premises, and they are paying the fee.

Once the consultant has finished their inspection, prepared the report and met with the Board, an Owners meeting should be convened to present a summary of the findings and have a question and answer session.

Next, the consultant prepares bid specifications to be sent to selected contractors. Between the consultant’s experience, the property manager’s recommendations and contractors known through the industry, they should be able to provide a sufficient number of qualified candidates. Bids should be opened and reviewed at a closed session of the Board. The list should be narrowed to three and then the three finalists could be interviewed, again, at a closed session of the Board. While such interviews are not legally required, it is just smart business. The only notable exception to this would be if the Association has had a positive experience with one of the contractors from a prior job, then an interview may be unnecessary.

Once the finalists are selected, and references have been checked, the Association is now ready to go to contract. Legal counsel is brought in to advise as to proper procedure for funding and to draft and/or review the agreement.

The legal documents for the Association must be reviewed to determine whether Owner approval is necessary for a special assessment or bank loan. In large construction projects, it is recommended that the American Institute of Architects (AIA) forms be finalized with appropriate riders.

Concurrently, when hiring the contractor, the Board must also retain the consultant who prepared the specifications and another specialist, as construction manager, to supervise the job and approve the work before payments are made. The construction manager will need a separate agreement outlining their duties and the relationship of the parties.

If the Board is considering financing the job, the contract and specifications can now be submitted to a lender’s underwriters in conjunction with an application for a loan. (It pays to select a lender that is familiar with Associations. The second you are asked, “So what will our collateral be?” – it’s time to head for the door!) Most property managers have a relationship with one or more lenders that specialize in granting loans to Associations and they can pave the way for a smooth application process and expeditious approval. Whether a loan is being obtained or the job is to be funded exclusively through assessments and reserves now is the moment for the Board to have the final discussion with the Owners.

Notice of a meeting of Owners needs to be sent in a timely fashion. The Board should be prepared to address all questions. Someone who is tactful, yet firm should be designated to run the meeting. It may be another director, a committee member, the manager, the consultant or even the lawyer. The main thing is to be fully prepared, facilitate an orderly discussion, try to diffuse the emotions and impart understanding to all those in attendance.

If Owner approval is not required, the Owners’ meeting which is purely informational and should be concluded in about one hour. Once the questions, comments and results begin becoming repetitive, the Chairperson needs to direct the discussion toward closure. Immediately following the Owners’ meeting, an open Board meeting should be convened with a single item on the agenda: levying the special assessment and hiring the contractor.

At this meeting, it may be necessary to conduct a vote, if warranted. A conscientious Board, when anticipating opposition, will identify supporters and make sure they have either voted or execute proxies. The vote, of course, is conducted according to standard parliamentary procedures: motion, second, discussion, vote and record in the minutes.

Lastly, a letter should then be sent to all Owners advising them that the special assessment passed, what their proportionate share is and when and how it will be paid. Consideration should be given to installment payments, a waiver of any interest to those who prepay, and a method of addressing legitimate financial hardship (those individuals should be encouraged to make themselves known to the Board as soon as possible so a closed session can be scheduled with them). Once Owners understand the facts and learn there are no alternatives, they will become resigned to their fate and be better prepared to understand how they can pay for these essential repairs.

FINAL DETAILS

When a special assessment has been levied which is payable over time, the property manager must note the assessment and the unpaid balance in any subsequent letters issued for closings or refinancing. The objective should be to collect the money as quickly as possible. Any Owner who is selling or refinancing, aside from making a proper disclosure to a Buyer and Lender should pay any balance at closing. An Association should not get itself in between a Buyer and Seller, as to who pays what. Rather the Seller is obligated to pay in full and it is his/her responsibility to negotiate with the Buyer, not that of the Board or the manager.

If a loan is being negotiated, it should initially be set up as a line of credit or construction loan for the gross amount. Once the prepayments have been determined (people who pay their full share in advance), it can then be converted to a fixed rate loan, so those Owners who are financing it over time, will pay the interest.

In keeping with its open communication policy, the Board should send periodic progress reports to the Owners so they can at least feel that their money is being used appropriately.

The funds collected from a special assessment should be segregated from the other reserves and operating accounts. Sometimes an Association may be faced with an emergency and has insufficient funds. Can they use the special assessment proceeds? In my opinion, in a bona fide emergency situation, the answer is yes. They can borrow this money from this fund, so long as there is a defined plan of repayment documented in the Minutes.

COLLECTIONS

Sadly, regardless of how much notice and information is communicated, there will always be a few Owners who refuse to pay or cannot pay. This is not fair to the diligent Owners who are struggling to make ends meet and fulfilling their obligation to have other Owners not holding up their end. Regardless of reasons, a willful delinquent must be taken to task, promptly. Whatever, the Association’s collection policies or what state law mandates, these Owners should receive a demand notice after being thirty (30) days late and then referred to legal counsel no later than sixty (60) days late. The sooner it is turned over, the sooner it can be collected.

CONCLUSION

In the 60’s, we used to say “seek pleasure, avoid pain”. None of this is pleasurable, but by following proper procedures and providing communication in abundance, it should curtail or even eliminate the pain. Thus, you will not need to walk around with galoshes, a raincoat and an umbrella.

Originally published in Common Interest (Summer 2008).

Since 1983, KSN has been a legal resource for condominium, homeowner, and townhome associations. Additionally, we represent clients in real estate transactions, collections, landlord/tenant issues, and property tax appeals. We represent thousands of clients and community associations throughout the US with offices in several states including Florida, Illinois, Indiana, and Wisconsin.

If our law firm can be of assistance, please call 855-537-0500 or visit www.ksnlaw.com.

This article is made available by the lawyer or law firm publisher for educational purposes only as well as to give you general information and a general understanding of the law, not to provide specific legal advice. By reading this article you understand that there is no attorney client relationship between you and the article author. This article should not be used as a substitute for competent legal advice from a licensed professional attorney in your state. © 2023 Kovitz Shifrin Nesbit, A Professional Corporation.